Munshify

Loan Origination System

Simple, secure, and scalable low-code, no-code lending platform.

We cater to a wide range of banks:

NBFSI

Co-Operative Banks

Private Sector Banks

Public Sector Banks

Rural Region Banks

Small Finance Banks

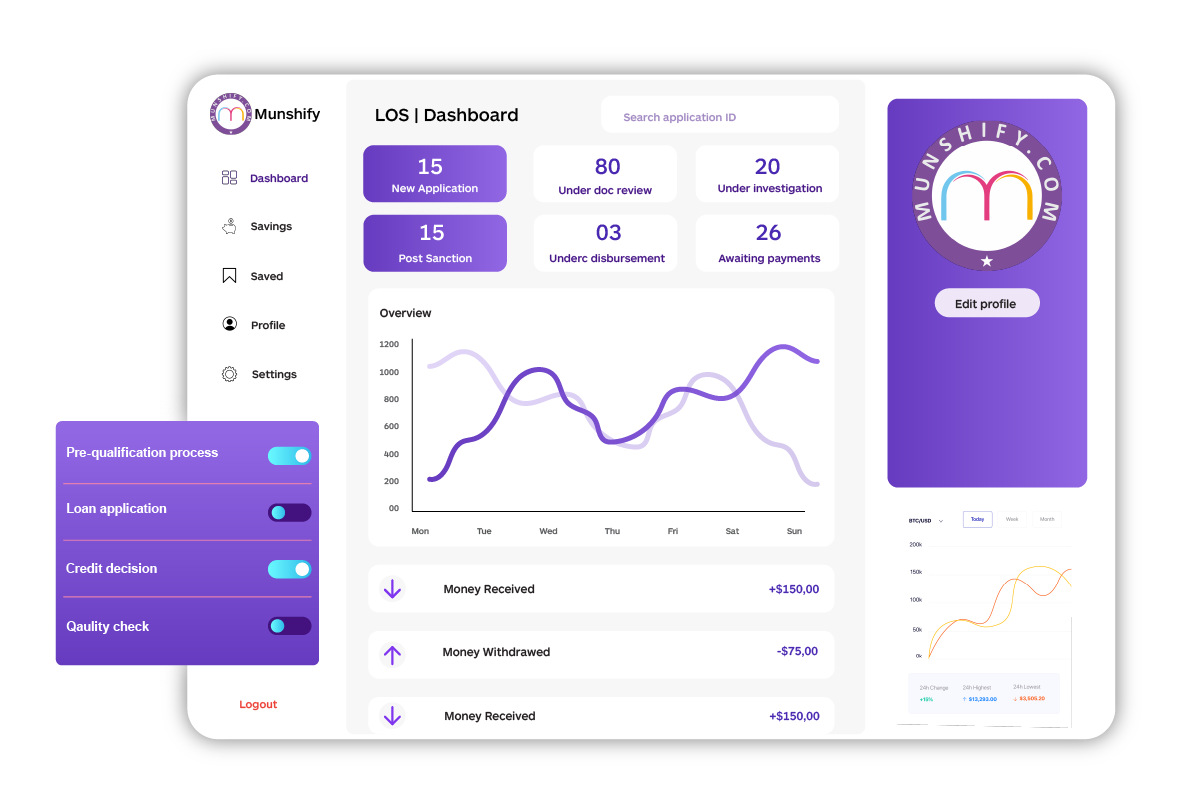

Munshify LOS

Track

Loan Process Seamlessly

The primary purpose of Munshify LOS is to facilitate a more efficient, accurate, and user-friendly lending experience. By leveraging technology, it aims to reduce manual workload, minimize errors, and speed up loan processing times, while ensuring compliance with regulatory standards.

Benefits of

Loan Origination System

- Automate the application and origination process

- Enable better efficiency with zero manual data entry

- Ensure a most transparent lending environment

- Reduced Turn-Around Time (TAT)

- Improved customer experience can lead to higher customer satisfaction & loyalty

- Helps lenders identify and mitigate risks and frauds

- By reducing manual work and improve efficiency, lenders can save time and money

Automated

Customer Onboarding

Say goodbye to heavy paperwork and lengthy processes. With Munshify LOS, customer onboarding is automated, allowing you to swiftly onboard new clients and get them started on their lending journey without delays.

Rapid

Loan Sanction

Time is of the essence in lending. Our platform enables rapid loan sanctioning, leveraging advanced algorithms and data analysis to expedite the approval process and provide quick decisions to applicants.

Digitized Data Collection & Management

Gone are the days of manual data entry and scattered documents. Munshify LOS digitizes data collection and management, centralizing all relevant information in one secure location for easy access and efficient processing.

Compliance Ready

Compliance is non-negotiable in the lending industry. Munshify LOS is built with compliance in mind, ensuring that your operations adhere to regulatory standards at every stage. Rest assured that your business remains compliant while leveraging the full capabilities of our platform.

Customization

Customizing your loan origination system (LOS) means aligning it with your specific operational parameters. This includes identifying key factors like loan volume and regulatory requirements, then modifying the LOS components to match. This customization streamlines the loan origination process, boosts efficiency, and ensures compliance.

Effortlessly Manage Secured and Unsecured Loans with Munshify LOS

- Home Loans

- Educational Loans

- Auto Loans

- Personal Loans

- Consumer Durable Loans

- Gold Loans

- Mortgage Loans

- Business Loans

- Loan on Deposits & LIC policies

Contact Us

Why Fill Out the Form?

Personalized Consultation

Receive a tailored solution that fits your organization’s unique needs.

Expert Insights

Get answers to all your queries from our experienced team.

Live Demo

Experience first-hand how our system can streamline your processes.

Exclusive Offers

Access special deals and discounts available only for our form respondents.

Don’t miss this opportunity to make a significant difference in your business’s future. Fill out the form now, and let’s start this transformative journey together!

FAQ

A Loan Origination System (LOS) is a software application that facilitates the loan application, processing, and approval process. It helps lenders manage the entire loan lifecycle, from application submission to loan closing.

Key features of a Loan Origination System include applicant data collection, credit decisioning, document management, compliance management, and loan servicing capabilities. LOS can also integrate with other systems such as credit bureaus and banking systems.

A Loan Origination System improves the loan process by automating manual tasks, reducing processing times, improving data accuracy, and ensuring compliance with regulations. It also provides better visibility into the loan pipeline and improves overall efficiency.

Using a Loan Origination System provides lenders with several benefits, including faster loan processing times, reduced operational costs, improved risk management, enhanced customer experience, and better regulatory compliance.

Munshify LOS utilizes low code no code technology, making customization easy and reducing the time required for project completion compared to traditional software development processes. This approach allows users to customize the system without extensive coding knowledge, streamlining the development and implementation process.

We are located at

eReleGo Technologies Pvt Ltd

646, 52, 12th Main Rd,

2nd Block, Rajajinagar,

Bengaluru, Karnataka 560010

Products & Services

About Company

Resources

For any queries reach out to us

- [email protected]

- +91 9986 994 328