As digital transactions become the norm, dynamic QR codes are revolutionizing contactless payments. Unlike static QR codes, which remain fixed, dynamic QR codes can be updated in real time, offering better security, flexibility, and efficiency.

The use of contactless payments has surged in the past decade. By 2025, over 60% of global digital transactions are expected to rely on QR codes, driven by consumer demand for convenience and safety. With growing adoption by governments and businesses, dynamic QR codes are leading the payment revolution.

Why Dynamic QR Codes Dominate Contactless Payments

Dynamic QR codes are reshaping the way businesses and consumers interact with digital payments. These QR codes are unique for each transaction, reducing fraud risks and enabling merchants to track payments efficiently.

Key Benefits Over Traditional Payment Methods

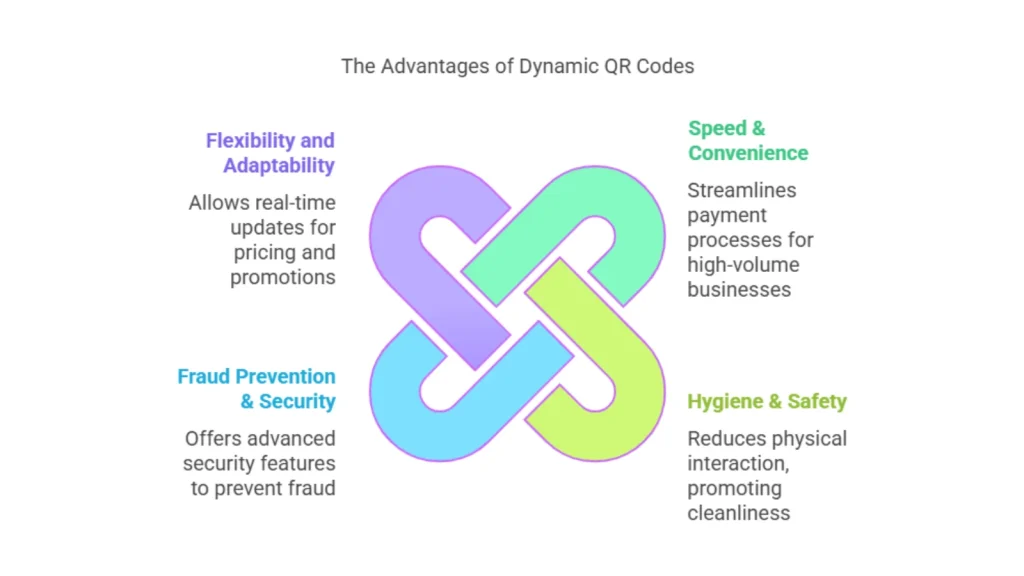

1. Speed & Convenience

Traditional payment methods often require multiple steps, such as inserting a card, entering a PIN, and waiting for approval. In contrast, dynamic QR codes streamline the process, allowing users to:

- Scan the code, confirm the payment, and complete the transaction within seconds.

- Avoid long checkout lines in retail stores, restaurants, and public transport systems.

- Experience a seamless payment journey without any need for physical cards or cash.

This efficiency is particularly beneficial for high-volume businesses, such as fast-food chains, supermarkets, and transit systems, where quick payments reduce wait times and improve customer flow.

2. Hygiene & Safety

The COVID-19 pandemic accelerated the adoption of contactless payment methods due to the need for minimal physical interaction. Even in a post-pandemic world, hygiene-conscious consumers continue to prefer touch-free payment options.

- Dynamic QR codes eliminate the need to touch payment terminals, keypads, or exchange cash.

- They provide a safe payment alternative in public places such as malls, restaurants, and transit hubs.

- They reduce the risk of spreading germs and viruses, promoting a healthier payment environment.

In many industries, businesses are now removing traditional payment systems altogether and switching to QR code-based transactions, ensuring both safety and efficiency.

3. Fraud Prevention & Security

Dynamic QR codes enhance security by reducing payment fraud and unauthorized transactions. Unlike static QR codes, which can be copied or altered, they generate unique, time-sensitive encryption for each transaction.

- One-time-use QR codes prevent cloning and unauthorized reuse.

- Tokenization and encryption ensure that customer data remains secure.

- Merchants can track and verify each transaction in real-time, reducing the chances of fraudulent activity.

4. Flexibility and Adaptability

Businesses benefit from the flexibility of dynamic QR codes by modifying pricing, discounts, and payment instructions in real-time.

- Restaurants: Easily update menu prices without reprinting QR codes.

- Retailers: Enable time-sensitive promotions and discount codes.

Why Businesses Are Making the Shift

The global shift toward cashless and card-free transactions is driving businesses across industries to embrace dynamic QR code payments. Some key reasons include:

- Lower operational costs: No need for expensive POS terminals.

- Wider accessibility: Works across different mobile devices and payment platforms.

- Real-time transaction tracking: Merchants can monitor sales and analyze customer behavior.

- Easy integration with digital wallets and banking apps.

Learn More: The Complete Guide to Multi-Touch Attribution Using QR Code Scans

Benefits for Businesses and Consumers

Increased Efficiency and Cost Savings

Dynamic QR codes make payments faster, helping customers check out quickly and reducing long lines. This improves the flow of people in stores and creates a better shopping experience. Businesses can also save money because QR code payments do not require expensive machines. Since customers only need a smartphone to scan and pay, businesses don’t have to spend extra on special payment devices.

Improved Customer Experience

QR code payments are quick and easy, making shopping more enjoyable. Customers don’t need to carry cash or cards, which makes paying simple and hassle-free. Businesses can also use QR codes to offer special discounts and rewards. These personalized offers keep customers happy and encourage them to return for more shopping.

Better Business Insights

With QR code payments, businesses can track sales and understand what customers like to buy. This information helps them improve their marketing, offer better deals, and make smarter business decisions. By studying shopping trends, businesses can create better offers and attract more customers.

Future Benefits of Dynamic QR Codes

Digital payments are changing fast, and dynamic QR codes are becoming a key part of this shift. These QR codes offer better security, convenience, and efficiency, making them a popular choice for businesses and consumers. As technology improves, QR code payments will become even safer and easier to use.

With these improvements, dynamic QR codes will become an even more secure and popular way to pay. AI, blockchain, and global standards will work together to make digital payments faster, safer, and more reliable. By 2025, QR code payments are expected to dominate digital transactions, shaping the future of contactless payments.

The Future of Contactless Technology

One big improvement is the use of artificial intelligence (AI) to prevent fraud. AI systems will monitor transactions in real time, spotting and stopping suspicious activity before it causes harm.

Blockchain technology will also make QR code payments more secure. A blockchain is a system that records transactions in a way that cannot be changed. When QR codes are linked to blockchain, fraud risks drop, and payments become more transparent. Businesses will also be able to track payments better, improving security and trust.

Dynamic QR codes are transforming the digital payment landscape by offering a secure, efficient, and adaptable payment method. As businesses and consumers continue to prioritize convenience, QR code payments will dominate in 2025.

Start using Dynamic QR Codes today! Get started with Munshify

FAQs on QR Code Payments

What is the difference between static and dynamic QR codes?

Static QR codes contain fixed information that remains unchanged after creation. People often use them to share links, contact details, or payment information. In contrast, dynamic QR codes allow real-time updates, making them ideal for payments, discounts, and personalized offers.

How secure are dynamic QR code payments?

Dynamic QR codes are very secure because they use encryption and special codes to protect payment details. Each transaction creates a new, unique QR code, which makes it difficult for hackers to copy or steal payment information.

Are QR code payments better than NFC payments?

Both QR code and NFC (Near Field Communication) payments have benefits. QR codes are cheaper to use because they only need a smartphone camera, while NFC requires special devices like card machines. QR codes are easier to use in places where NFC technology is not available.

How do businesses use dynamic QR codes for payments?

Businesses can set up dynamic QR code payments using banks, payment apps, or special platforms that create unique codes for each transaction. These codes can be shown on a screen, printed on receipts, or sent in invoices to make payments quick and easy.

What are the trends for QR code payments in 2025?

QR code payments will become more popular worldwide. AI technology will make transactions safer by detecting fraud. More countries will introduce standard QR payment systems, allowing people to use QR codes easily for shopping, travel, and online payments.

Can QR codes be used for big payments?

Yes, dynamic QR codes can handle large payments safely. They connect to secure financial networks and add extra steps to verify the transaction. This makes sure even high-value payments are safe and follow legal rules.

See how Dynamic QR Codes are changing contactless payments in 2025! Check it out at munshify.com.