Accelerate Loan Approvals and Slash Manual Work with Munshify LOS

Streamline the lending lifecycle—from application to disbursement—with zero code.

Transform Your Lending Process

See how Munshify eliminates traditional lending bottlenecks

Traditional Challenges

- Traditional Challenges

- Lengthy approval processes

- Inconsistent credit evaluations

- Compliance management overhead

- Limited visibility into loan status

Munshify Solutions

- Automated digital workflows

- Real-time approval decisions

- AI-powered credit scoring

- Built-in compliance framework

- Complete loan lifecycle visibility

Powerful Features for Modern Lenders

Everything you need to digitize and optimize your loan origination process

End-to-End Loan Lifecycle Automation

Streamline every step from application to disbursement

Configurable Credit

Policies

Customize risk assessment rules to match your criteria

Multi-Channel Application Intake

Accept applications from web, mobile, and partner channels

Borrower & Agent

Portals

Self-service portals for seamless user experience

Integrated Compliance Checks

Built-in regulatory compliance and audit trails

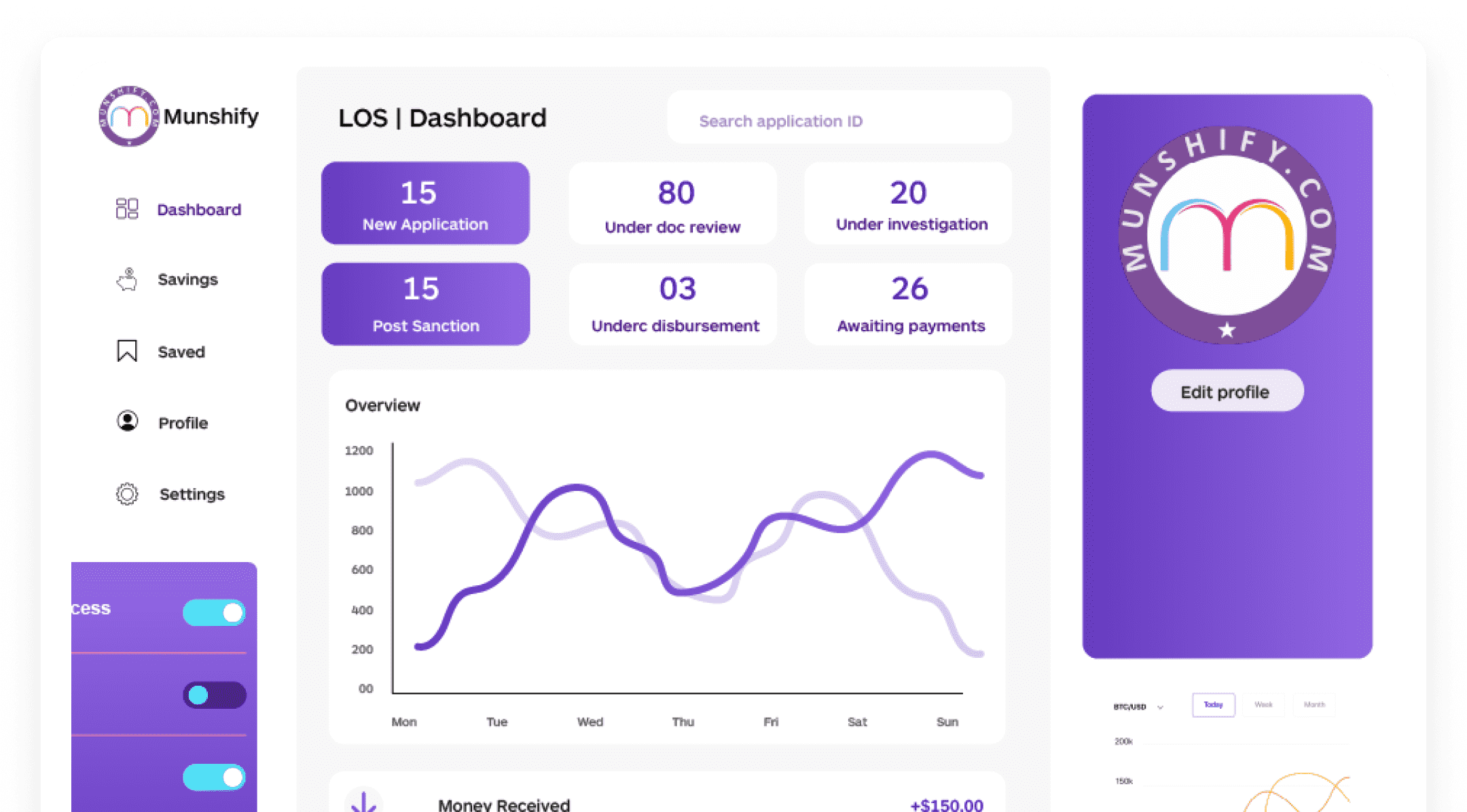

Custom Dashboards & Reporting

Real-time insights and customizable analytics

Tailored Lending Solutions for Every Banking Segment

Powering end-to-end loan journeys—from NBFSIs to Co-Operatives—with scalable automation and compliance-first workflows.

NBFSI

Scalable and agile loan processing solutions

Private Sector

Smart workflows for high-volume lending

Public Sector

Transparent and compliant lending workflows

Co-Operative

Faster member-based loan disbursals

Small Finance

Custom workflows for micro and small loans

Public Sector

Transparent and compliant lending workflows

Tailored Lending Solutions for Every Banking Segment

Powering end-to-end loan journeys—from NBFSIs to Co-Operatives—with scalable automation and compliance-first workflows.

NBFSI

Scalable and agile loan processing solutions

Private Sector

Smart workflows for high-volume lending

Public Sector

Transparent and compliant lending workflows

Co-Operative

Faster member-based loan disbursals

Small Finance

Custom workflows for micro and small loans

Public Sector

Transparent and compliant lending workflows

Seamless Integrations

Connect with Tools You Already Use

Munshify Forms works smoothly with your favorite apps and platforms — from spreadsheets to email to internal tools

Excel

Slack

Digi Locker

Google Sheets

NSDL

Seamless Integrations

Connect with Tools You Already Use

Munshify Forms works smoothly with your favorite apps and platforms — from spreadsheets to email to internal tools

Excel

Slack

Digilocker

Google Sheets

NSDL

Enterprise-Grade Security & Compliance

Built with security-first architecture and comprehensive compliance frameworks

Data Protection

End-to-end encryption, secure data storage, and privacy compliance

Audit Trails

Complete activity logging and audit trails for regulatory compliance

API Integration

Seamless integration with regulatory APIs and compliance systems

Frequently asked questions

Loan Origination System Software is a digital solution that automates the entire loan lifecycle from application intake and document collection to underwriting, approval, and disbursement.

A Loan Origination System Software streamlines loan processes through automation. It captures application data, verifies documents, conducts credit scoring, and facilitates approval of workflows, all in one platform.

Loan Origination System Software is essential for lenders as it reduces processing time, minimizes manual errors, ensures regulatory compliance, and improves overall loan approval efficiency.

Benefits of using Loan Origination System Software include faster processing, better compliance, real-time loan status tracking, improved borrower experience, and reduced operational costs.

Yes, Loan Origination System Software typically offers API support to integrate with third-party services like CRMs, credit bureaus, KYC platforms, and payment gateways.

Yes, Loan Origination System Software platforms offer customization options, allowing lenders to tailor workflows, decision rules, dashboards, and reports based on business requirements.

Loan Origination System Software includes audit trails, automated documentation, and real-time monitoring features that help ensure compliance with financial regulations.

Loan Origination System Software is ideal for banks, NBFCs, fintech companies, housing finance firms, and any lending organization aiming to automate and scale their loan operations.

Loan Origination System Software can manage various loan types including personal loans, home loans, vehicle loans, business loans, and education loans with customizable workflows.

Yes, Loan Origination System Software is scalable and can be tailored for small lenders, enabling them to automate loan processes without heavy IT investments.