Simplify Loan Processing with a Powerful Loan Origination System

Simple, secure, and scalable low-code, no-code lending platform.

Enhance efficiency, reduce paperwork, and expedite approvals with our Loan Origination System trusted by leading financial institutions.

Simplify Loan Processing with a Powerful Loan Origination System

Simple, secure, and scalable low-code, no-code lending platform.

Enhance efficiency, reduce paperwork, and expedite approvals with our Loan Origination System trusted by leading financial institutions.

Why Choose Our Loan Origination System?

Optimize Efficiency & Reduce Costs

Enhance Compliance & Risk Management

Seamless Customer Experience

Flexible & Scalable Solution

Loan Origination System Adoption

in the Banking Industry

200+

Successful Implementations

100+

Banks Financial Institutions

50%

Faster Loan Processing Time

Reduction in Operational Costs

Key Features of Our Loan Origination System

Automated Workflow Management

Automate repetitive tasks, improve efficiency.

Credit Risk Assessment

AI-powered risk profiling.

Regulatory Compliance

Built-in compliance management

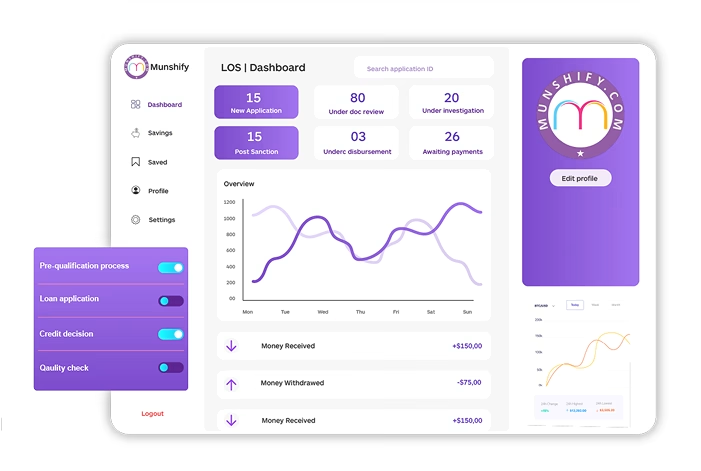

Customizable Dashboard

User-friendly interface with real-time insights.

Multi-Language Support

Tailored for diverse banking needs.

Customizable Dashboard

User-friendly interface with real-time insights.

Key Features of Our Loan Origination System

Successful Implementations

Automated Workflow Management

Automate repetitive tasks, improve efficiency.

Credit Risk Assessment

AI-powered risk profiling.

Regulatory Compliance

Built-in compliance management

Customizable Dashboard

User-friendly interface with real-time insights.

Multi-Language Support

Tailored for diverse banking needs.

Customizable Dashboard

User-friendly interface with real-time insights.

Types of Banks We Cater To

Custom Solutions for Every Banking Institution

Streamline your loan processing with our intelligent, end-to-end Loan Origination System.

Automate approvals, ensure compliance and reduce operational costs with seamless digital workflows.

NBFSI

Co-Operative

Private Sector

Public Sector

Rural Region

Small Finance

Types of Banks We Cater To

Custom Solutions for Every Banking Institution

Streamline your loan processing with our intelligent, end-to-end Loan Origination System.

Automate approvals, ensure compliance and reduce operational costs with seamless digital workflows.

NBFSI

Co-Operative

Private Sector

Public Sector

Rural Region

Small Finance

Transform Your Loan Processing with the Best Loan Origination System

Comprehensive Loan Coverage for All Lending Needs

Personal Loans

Home Loans

Auto Loans

Business Loans

Mortgage Loans

Education Loans

Gold Loans

Vehicle Loans

Seamless Integration Across All Banking Tools

Integrate Effortlessly with Your Existing Tech Stack

01

Systems

02

APIs

03

Verification Tools

Gateways

Communication

Why Wait? Upgrade Your Loan Origination System Now

Get in touch with our experts and see how our LOS software can help your bank grow.

We are located at

India : eReleGo Technologies Pvt Ltd

646, 52, 12th Main Rd,

2nd Block, Rajajinagar,

Bengaluru, Karnataka 560010

USA : eReleGo Tech Partners LLC

929 E Lodgepole Dr Gilbert, Arizona, USA.